top of page

Deadline 18 August: Mid-Year 2025 Accounting Reporting System – Ordinance 1194/2025

Romania’s Ministry of Finance approves Ordinance 1194/2025, setting the mid-year 2025 accounting reporting system for companies with over €1M turnover. Deadline: August 18, 2025.

Aug 15, 2025

Romania Hikes VAT to 21% – Major Tax Changes from August 2025

Romania raises its standard VAT from 19% to 21% on Aug 1, 2025, and unifies the 5% and 9% reduced VAT rates at 11% under new fiscal law 141/2025.

Jul 31, 2025

High Fiscal Risk Criteria Updated in Romania: New Rules from ANAF & Customs

Romania publishes detailed criteria to identify high fiscal risk companies under the Fiscal Code. See who is targeted and how the risk assessment works. High Fiscal Risk Rules for Businesses | ANAF Order 417/2025

Jul 31, 2025

Romania Launches Centralised Sanctions Registry for RO e-Transport

Starting July 2025, Romanian authorities use a centralised registry for sanctions under the RO e-Transport system. Learn how ANAF, Customs and Police apply and update penalties.

Jul 26, 2025

e-Factura Grace Period Extended for Excise Goods: New Fiscal Amendments in Law No. 138/2025

Romania extends the transitional period for e-Factura and excise product marking through Law No. 138/2025. Learn what it means for your business.

Jul 24, 2025

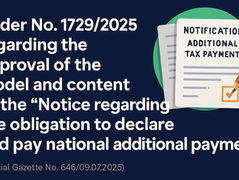

New Reporting Form for National Top-Up Tax Approved by ANAF

Romania’s National Agency for Fiscal Administration (ANAF) has officially approved the model and content of the “Notification on the...

Jul 23, 2025

Order 1815/2025: New Customs Laboratory Rules for Sample Analysis

Romania adopts new technical rules under Order 1815/2025 for customs laboratory procedures. Learn what’s analysed, who performs it, and how results are certified.

Jun 19, 2025

New Reporting Rules for Foreign Oil and Gas Companies Operating in Romania

Romania enforces strict reporting deadlines for foreign companies in the oil and gas sector under Order no. 689/1750/2025. Learn what’s required and how to stay compliant.

May 30, 2025

New 2025 KYC Rules for Crypto, FX, and Real Estate

Law 86/2025 sets new AML rules for crypto, FX bureaus, casinos, and real estate. New KYC thresholds apply. See full changes here.

May 27, 2025

Tax Payment Easements: ANAF Updates Both Classic and Simplified Instalment Procedures

The Romanian tax authority (ANAF) has issued OPANAF no. 597/2025, updating the procedures for granting payment instalments—both classic and simplified—based on multiple amendments to the Fiscal Procedure Code over recent years.

May 26, 2025

New Tariff Approved for Electricity Trade with Romania’s Neighbours

Romania sets a regulated tariff of €1.50/MWh (excluding VAT) for electricity exchanges with neighbouring countries, as per Order No. 16/2025.

May 21, 2025

New Reporting Rules for Romania’s Mining Activity Tax

Ordinance No. 241/2025 introduces detailed technical instructions for the registration, reporting, calculation, and payment of mining activity taxes and royalties. Learn what mining license holders must do in 15 days.

May 18, 2025

Romanian Energy Transition Fund Contribution – Reporting Update Effective April 2025

New Reporting Obligation for Energy Market Entities: Energy Transition Fund Contribution from April 2025

May 16, 2025

ICCJ: Taxpayers Can Rectify Tax Forms Beyond Formal Errors

Romania’s High Court confirms taxpayers may amend tax forms to correct the taxable base—not just clerical errors—within the statute of limitation. Learn how Decision No. 61/2025 impacts your tax compliance.

Apr 28, 2025

REGES-ONLINE 2025: New Digital Rules for Employers in Romania

HG 295/2025 replaces REGES with REGES-ONLINE. Learn the new employer reporting duties and key deadlines for contract entries, terminations, and corrections.

Apr 28, 2025

New SAF-T Filing Rules in Romania: What Every Business Must Know in 2025

Discover Romania's updated SAF-T (D406) reporting requirements for 2025 under Ordinul 407/2025. Learn who must file, key deadlines, and crucial exceptions.

Apr 16, 2025

New Reduced Tax Rates for Special Constructions in Romania

Romania introduces differentiated tax rates for special constructions, with reduced rates of 0.5% and 0.25% and a 10% early payment bonus.

Apr 9, 2025

New CAEN Rules Apply Now: 18 Months to Update Your Business Code

As of 1 January 2025, Romania has adopted CAEN Rev. 3. All businesses and institutions must update their codes within 18 months.

Mar 26, 2025

Uber & Bolt Must File Monthly Tax Reports: ANAF Form 397 Now Mandatory

Ride-sharing platforms like Uber and Bolt must now file monthly Form 397 with ANAF, disclosing all driver and trip data. See what’s required

Mar 26, 2025

ANAF's New Directions Under Ordinance 402/2025 – What to Expect in 2025

ANAF updates list of documents issued via the Central Printing Centre. See the 17 new types of fiscal and procedural acts.

Mar 24, 2025

New Health Insurance Rules Under OUG 8/2025

The Romanian government has introduced OUG 8/2025 , modifying Law No. 95/2006 on health sector reform and other related regulations....

Mar 13, 2025

New State Aid Monitoring and Recovery Rules for SMEs

2025 Update: Romania strengthens state aid monitoring and recovery for SMEs under Agro IMM INVEST and RURAL INVEST.

Mar 7, 2025

New Tax Registration Rules for Non-Residents in Romania

Romania introduces a new tax registration procedure for non-residents through public notaries. Learn the key steps and requirements in 2025.

Mar 3, 2025

2025 Internal Audit Limits for Public Entities

The Ministry of Finance (MF) has established the audit ceiling for 2025 under Order nr. 319/2025 , ensuring that central public...

Mar 2, 2025

bottom of page